Singlife

Legacy Indexed

Universal Life

Grow your financial legacy with a strategic blend of life insurance and potential high-growth investments

Discover Singlife Legacy Indexed Universal Life (IUL), a combination of life protection and investment solutions. Effectively grow your policy’s cash value with a Fixed Account that offers a minimum guaranteed crediting rate and an Index Account that’s tied to the market performance of two internationally recognised indices.

Plus, with market downturn protection and flexible premium payments1, Singlife Legacy IUL empowers you to craft your legacy on your terms.

Key Features

Life insurance coverage

Provides lifelong protection against death and Terminal Illness.

Earn higher potential returns

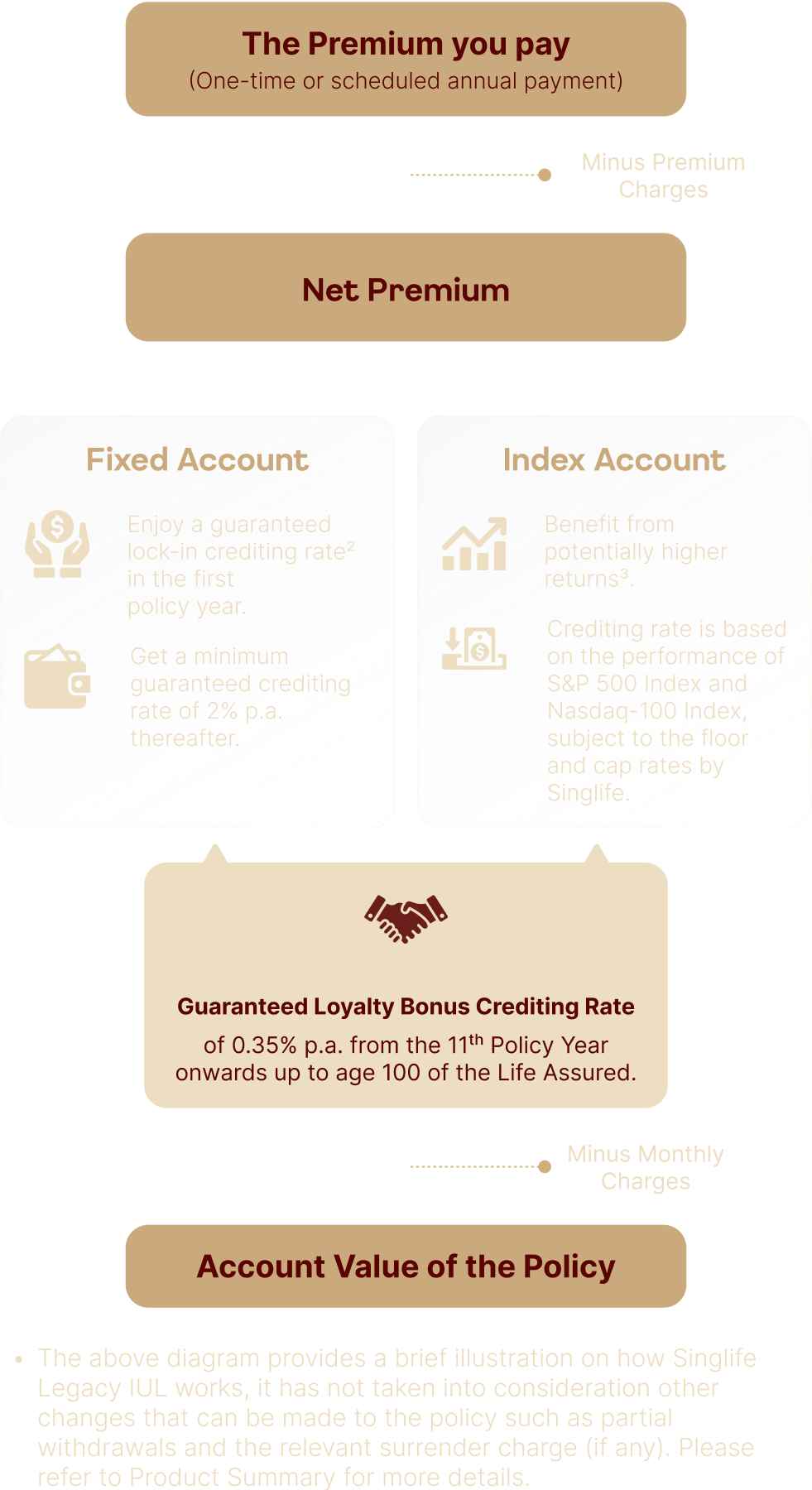

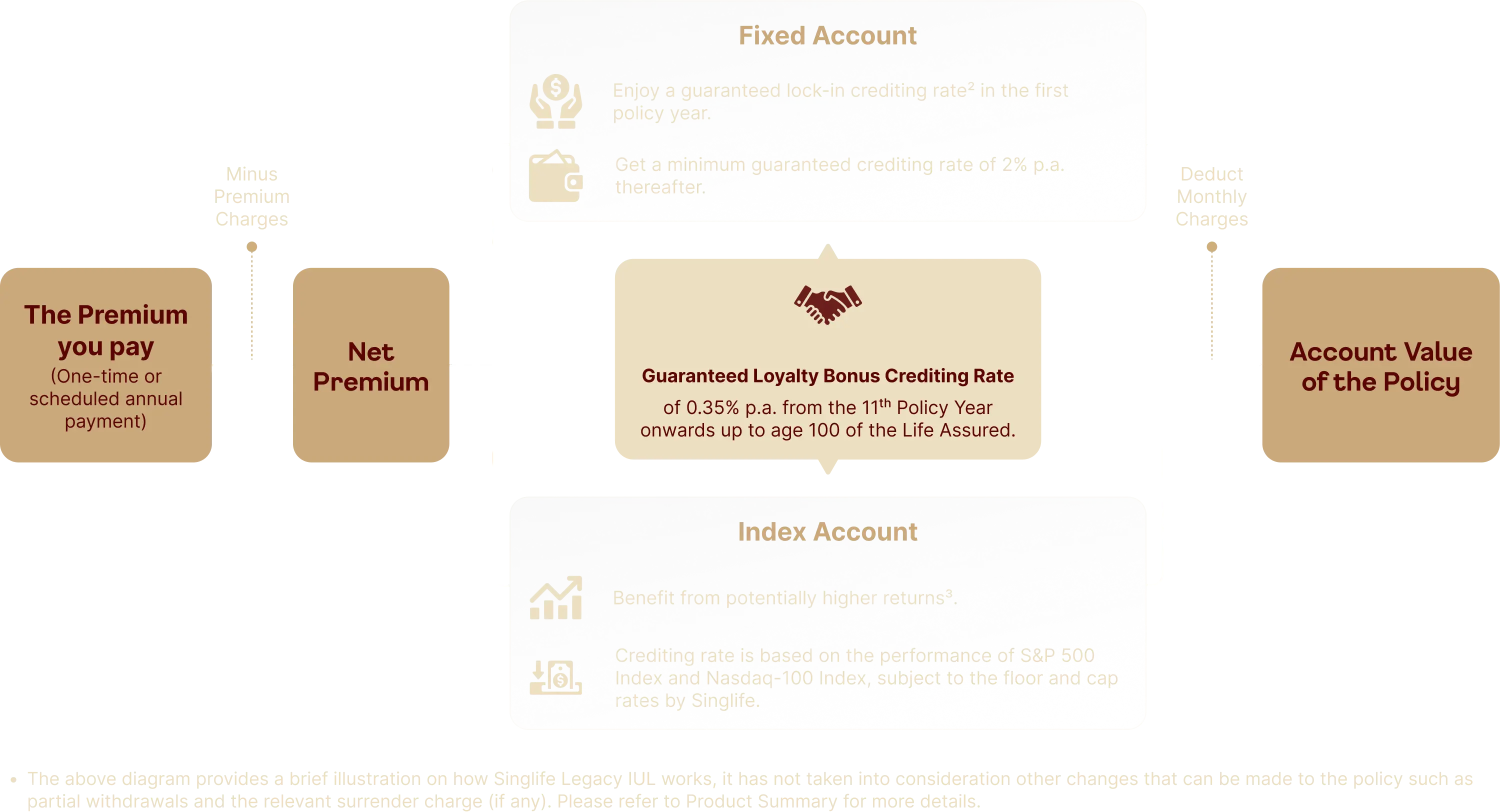

Enjoy a guaranteed lock-in crediting rate2 and a minimum guaranteed crediting rate of 2% p.a. with the Fixed Account, and benefit from potentially higher returns3 with the Index Account.

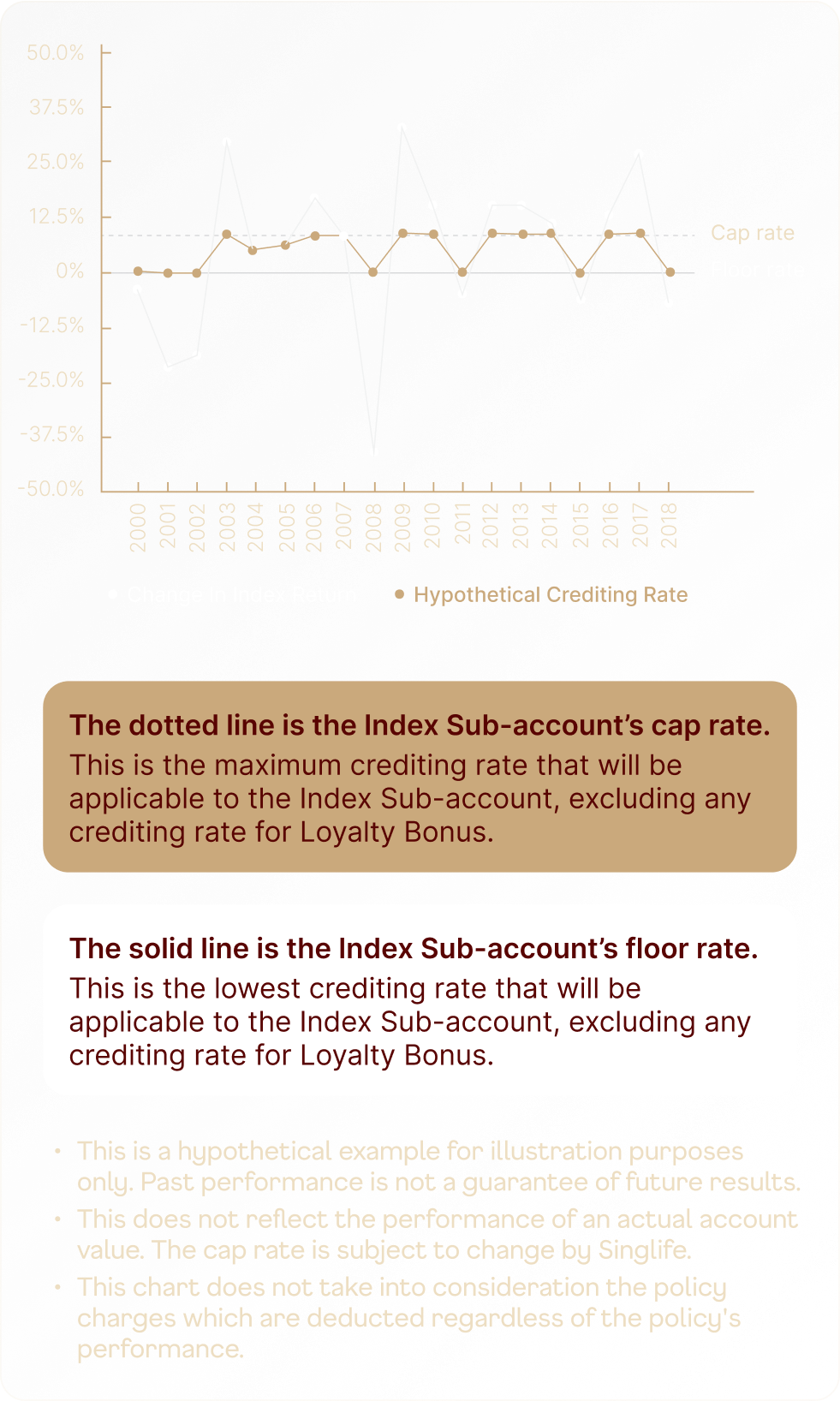

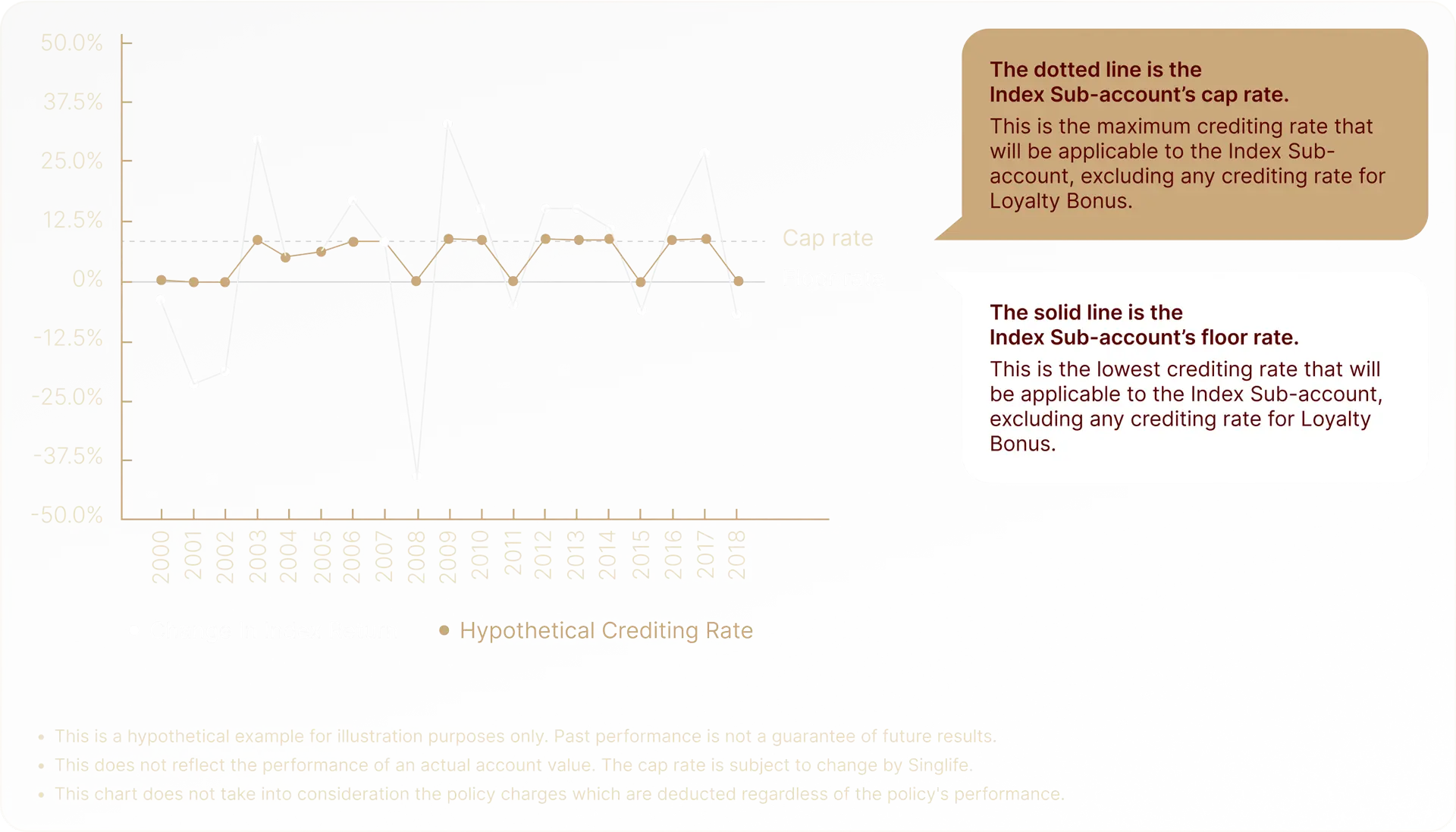

Protection from market downturn

With a guaranteed floor rate of 0% p.a. on the Index Account, stay confident knowing that your investments won’t suffer from a negative return, even in a market downturn.

Other Features and Benefits

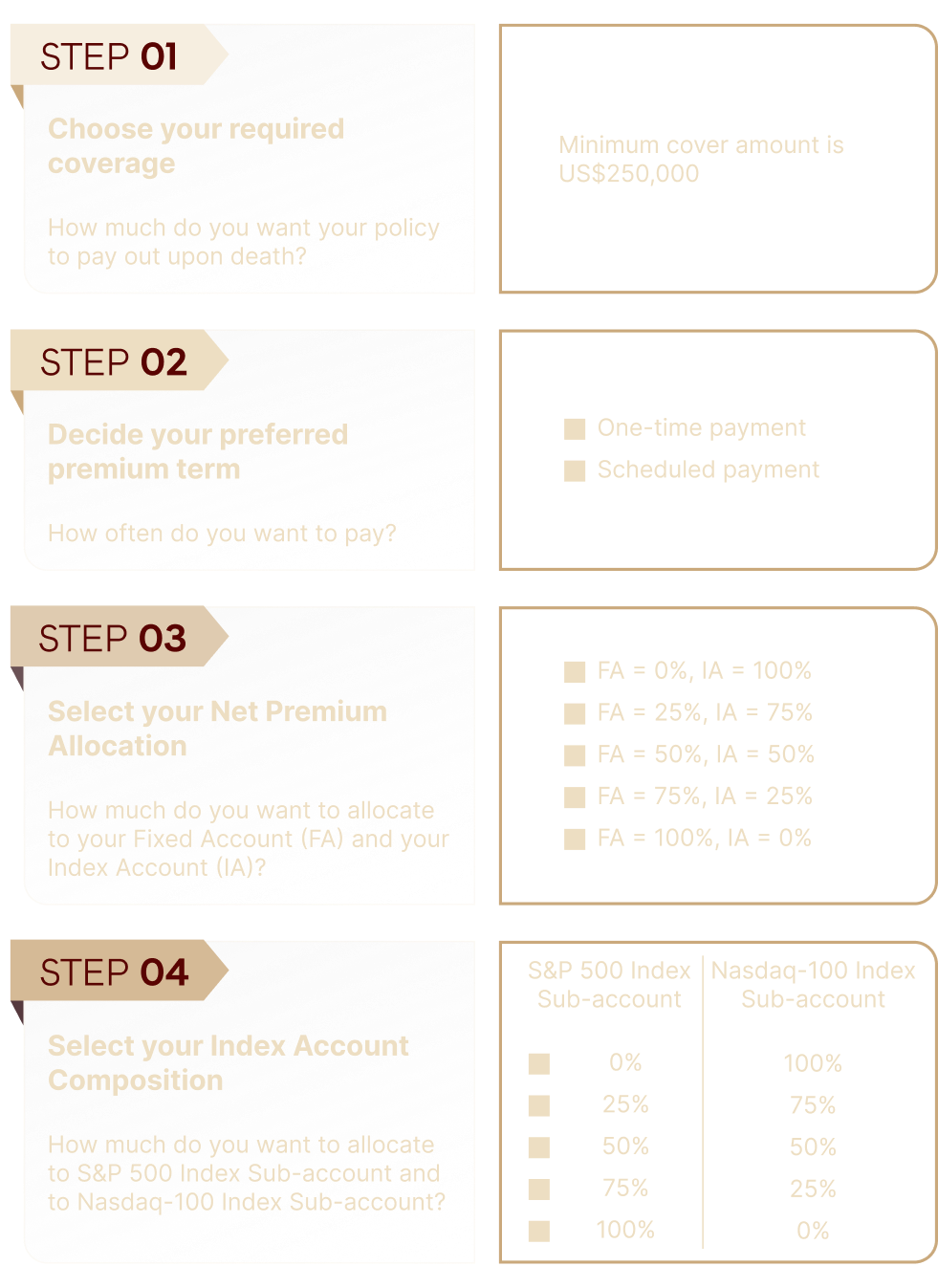

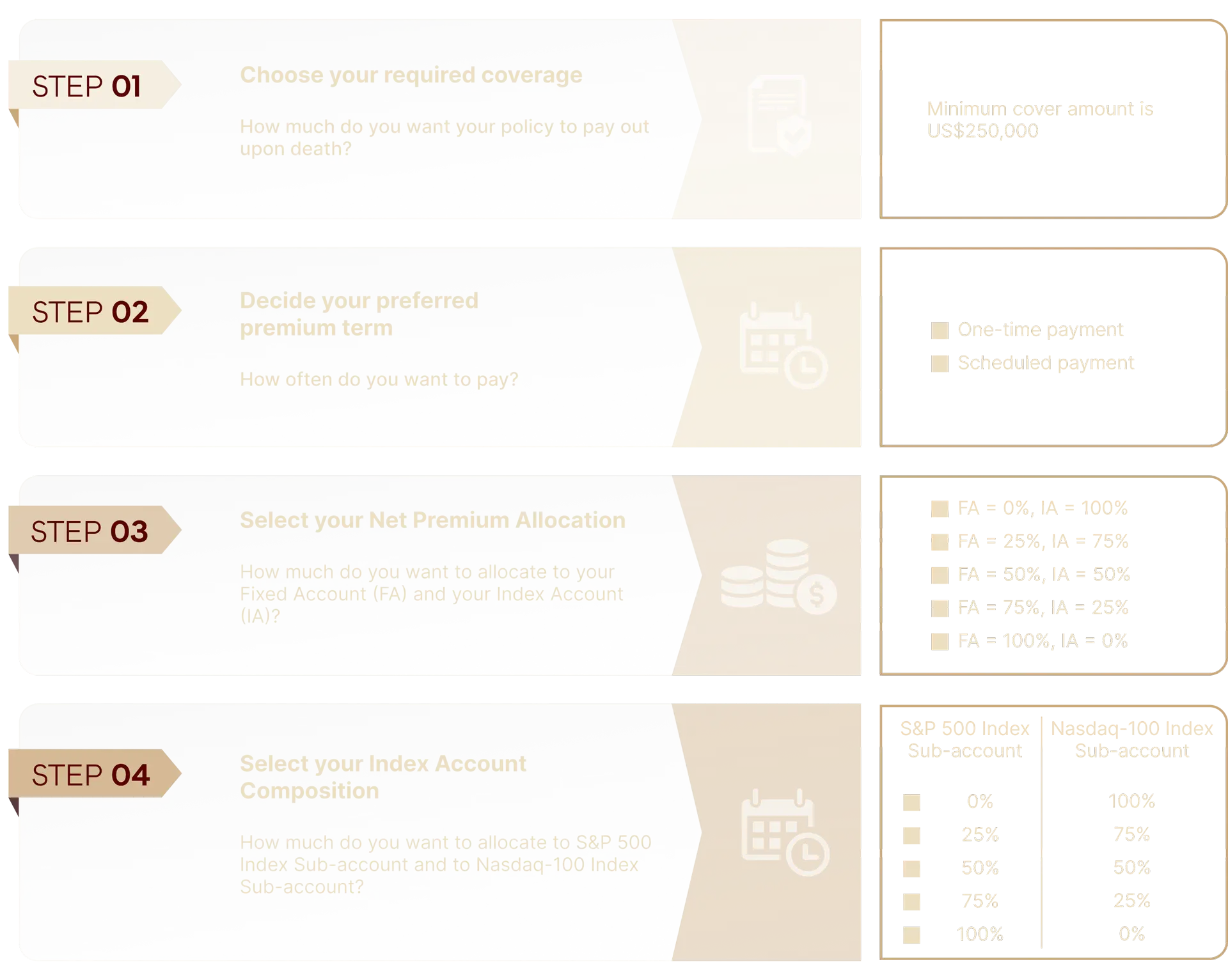

One of the most accessible IULs in the market with coverage starting from US$250,0004

Enjoy a Loyalty Bonus Crediting Rate of 0.35% p.a. from the 11th Policy Year onwards up to age 100 of the Life Assured6

Protect your key employee with this plan to maintain your business resilience and continuity

Flexible premium payments7 and premium allocation between the Fixed Account and Index Account

Enjoy penalty free withdrawal of up to 5% of the account value once every policy year from the 6th Policy Year onwards8

Option to reallocate or rebalance the values9 between the Fixed Account and Index Account

Option to switch Life Assured10 to ensure financial stability in your business or personal life

Getting Started with Singlife Legacy IUL

Your Fixed Account and Index Account Explained

How Our Cap and Floor Rates Work for the Index Sub-Account

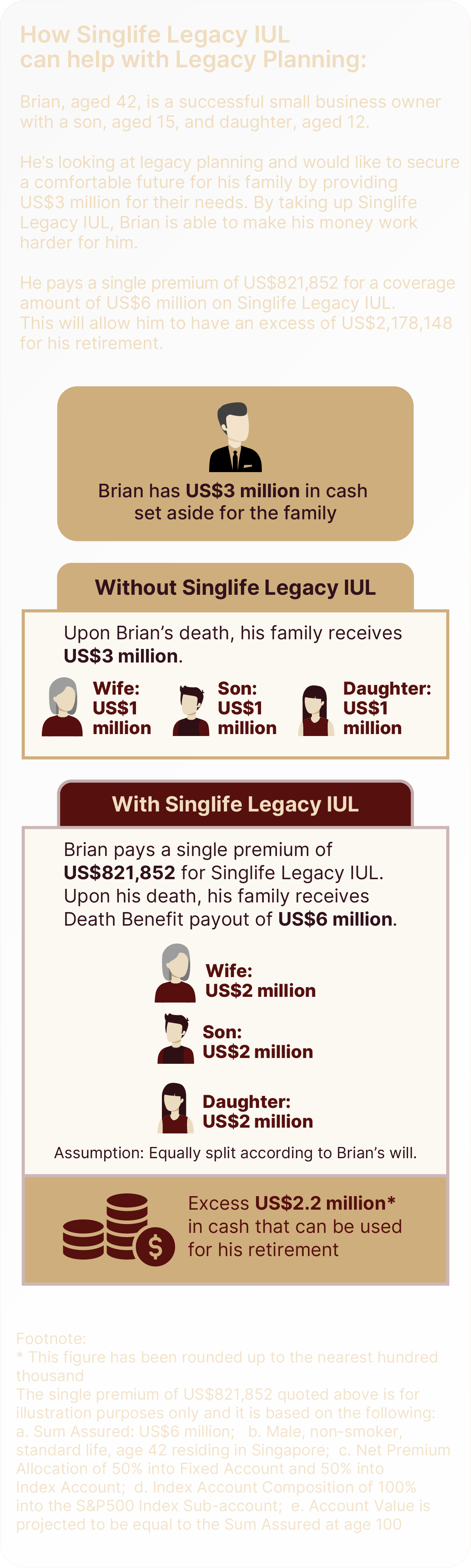

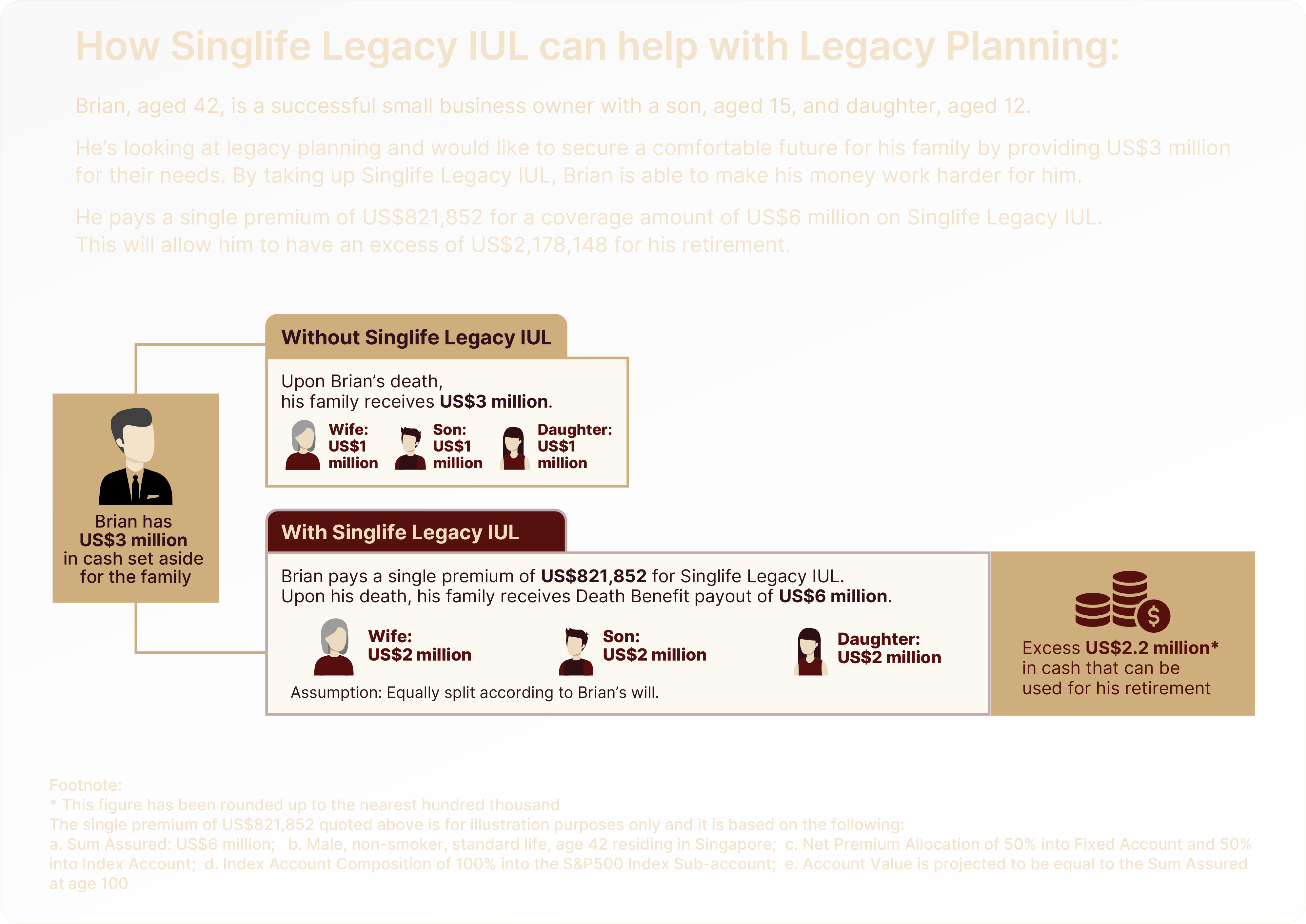

Here's How Singlife Legacy IUL Works:

Start building your legacy today

For a personalised consultation on Singlife Legacy Indexed Universal Life, simply complete the form, and a dedicated Financial Adviser Representative will be in touch.

Prefer to speak with someone? Our team at Singlife Financial Advisers (“SFA”), a wholly owned subsidiary of Singapore Life Ltd. (“Singlife”) is here to assist you. Reach us at 6827 9980 (Mon – Fri, 9am to 6pm).

Yay! Form received

Oh no! We encountered an error

All ages mentioned refer to age next birthday.

1 Premium payments are flexible after the Policy is issued, the Policyholder may skip a premium or discontinue premium payment entirely as long as the Policy has sufficient value for the deduction of monthly charges. Please refer to the Product Summary for more details.

2 The Lock-in Guaranteed Crediting Rate is applicable to the Fixed Account in the 1st Policy Year and it is equal to the current crediting rate for the Fixed Account. Please refer to the Policy Illustration and Product Summary for more details.

3 Crediting rate for Index Sub-account of the Index Account is calculated based on the point-to-point performance of the underlying indices, excluding dividends, subject to the floor and cap rates by Singapore Life Ltd. (Singlife), plus guaranteed Loyalty Bonus Crediting Rate (if any).

4 The minimum Sum Assured for this product is US$250,000.

5 This feature is only applicable provided that the following conditions are met:

Please refer to the Product Summary for more details.

6 Loyalty bonus applies from the 11th Policy Year onwards (up to age 100 of the Life Assured) on both the Fixed Account and Index Account to further grow policy value.

7 The Policyholder can pay premiums any time before the Policy Anniversary on which the Life Assured is age 100, subject to the minimum and maximum premium limit. The Policyholder can also change the premium allocation between the Fixed Account and Index Account based on their financial goals and preference.

8 Starting from the 6th Policy Year to the 10th Policy Year, the Policyholder can apply to withdraw up to 5% of the Account Value under the Penalty Free Partial. Withdrawal Benefit, once in each applicable Policy Year subject to the benefit terms and conditions. Please refer to the Product Summary for more details.

9 The Policyholder can apply for Account Reallocation and/or Account Rebalancing 1 year after the Policy Issue Date and before the Policy Anniversary on which the Life Assured is age 100. Each request must be at least 1 year apart from the completion of the previous request based on the transaction date. Please refer to the Product Summary for more details.

10 The Policyholder can request for a change of Life Assured after the first Policy Year subject to the terms and conditions. Any request to change the Life Assured is subject to acceptance by Singlife. Please refer to the Product Summary for more details on the terms and conditions.

S&P 500 Index

The S&P 500 Index is a product of S&P Dow Jones Indices LLC or its affiliates (“SPDJI”) and has been licensed for use by Singapore Life Ltd. Standard & Poor’s® and S&P® are registered trademarks of Standard & Poor’s Financial Services LLC (“S&P”); Dow Jones® is a registered trademark of Dow Jones Trademark Holdings LLC (“Dow Jones”); and these trademarks have been licensed for use by SPDJI and sublicensed for certain purposes by Singapore Life Ltd. Singlife Legacy Indexed Universal Life is not sponsored, endorsed, sold or promoted by SPDJI, Dow Jones, S&P, or their respective affiliates, and none of such parties make any representation regarding the advisability of investing in such product(s) nor do they have any liability for any errors, omissions, or interruptions of the S&P 500 Index.

Nasdaq-100 Index

Nasdaq®, Nasdaq-100 Index®; Nasdaq-100®; NDX®, are registered trademarks of Nasdaq, Inc. (which with its affiliates is referred to as the “Corporations”) and are licensed for use by Singapore Life Ltd. Singlife Legacy Indexed Universal Life (the “Product”) has not been passed on by the Corporations as to their legality or suitability. The Product is not issued, endorsed, sold, or promoted by the Corporations. The corporations make no warranties and bear no liability with respect to the product.

See our full suite of products

Rely on our curated solutions to ensure a secure financial future

Disclaimers

This policy is underwritten by Singapore Life Ltd.

This is published for general information only and does not have regard to the specific investment objectives, financial situation and particular needs of any specific person. You may get a copy of the Product Summary from Singapore Life Ltd and the participating distributors’ offices. You should read the Product Summary before deciding whether to purchase the product. You may wish to seek advice from a financial adviser representative before making a commitment to purchase the product. If you choose not to seek advice from a financial adviser representative, you should consider whether the product in question is suitable for you.

As buying a life insurance policy is a long-term commitment, an early termination of the policy usually involves high costs and the surrender value, if any, that is payable to you may be zero or less than the total premiums paid. This is not a contract of insurance. Full details of the standard terms and conditions of this policy can be found in the relevant policy contract.

Information is accurate as at 5 September 2024.

This advertisement has not been reviewed by the Monetary Authority of Singapore.

This policy is protected under the Policy Owners’ Protection Scheme which is administered by the Singapore Deposit Insurance Corporation (SDIC). Coverage for your policy is automatic and no further action is required from you. For more information on the types of benefits that are covered under the scheme as well as the limits of coverage, where applicable, please contact us or visit the Life Insurance Association or SDIC websites (www.lia.org.sg or www.sdic.org.sg).