Singlife

Multipay Critical Illness II

Safeguard your lifestyle with a multiple-payout critical illness plan.

Preserve your wealth, legacy and freedom of choice with a critical illness plan that provides multiple payouts – because life’s uncertainties shouldn’t compromise what you’ve built.

With Singlife Multipay Critical Illness II, your protection extends beyond one diagnosis. Receive payouts across different stages of critical illness allowing you to stay firmly in control of your lifestyle and independence through life’s unexpected turns.

An increasing number of Singaporeans are being diagnosed with serious illnesses at younger ages and earlier stages.

1 in 2 women (over 57%) are diagnosed at Stage 1, up from 1 in 3 a decade ago¹.

10.4% more cases were reported in 2017–2021 vs 2008–2012, rising to 12,600 cases from 11,416 ².

Incidence has doubled from approximately 5 to 10 per 100,000 between 1968 and 2019³.

Early detection reflects better screening capabilities and public awareness. It also enables early treatment, which improves outcomes and recovery chances. Yet certain illnesses may recur, and new conditions may arise, underscoring the importance ongoing protection.

More than 1 in 3 patients with diffuse large B-cell lymphoma experience a relapse or die within 5 years⁴.

Up to 15% risk of recurrence each year⁵.

7% to 11% risk of recurrence within 5 years for early-stage cases⁶.

How Singlife Multipay Critical Illness II protects you

Receive up to 900% of your Sum Assured in total payouts, with coverage from early diagnoses to recurrent critical illnesses (CIs).

Singlife Multipay Critical Illness II provides ongoing financial support across different stages of critical illness, even if a covered condition recurs. This way, you can focus on recovery with confidence, without disrupting your investments or long-term wealth strategy.

Multiple payouts

Get up to 900% of your Sum Assured with multiple payouts across different critical illnesses7

Comprehensive coverage

Get protection for 135 conditions across early, intermediate and severe stages of critical illnesses⁸

Protection against recurring critical illness

Receive 150% of your Sum Assured for specified or recurrent severe stage conditions – up to 300% total9

Premium waiver

Premium payments cease upon diagnosis of the first severe stage critical illness

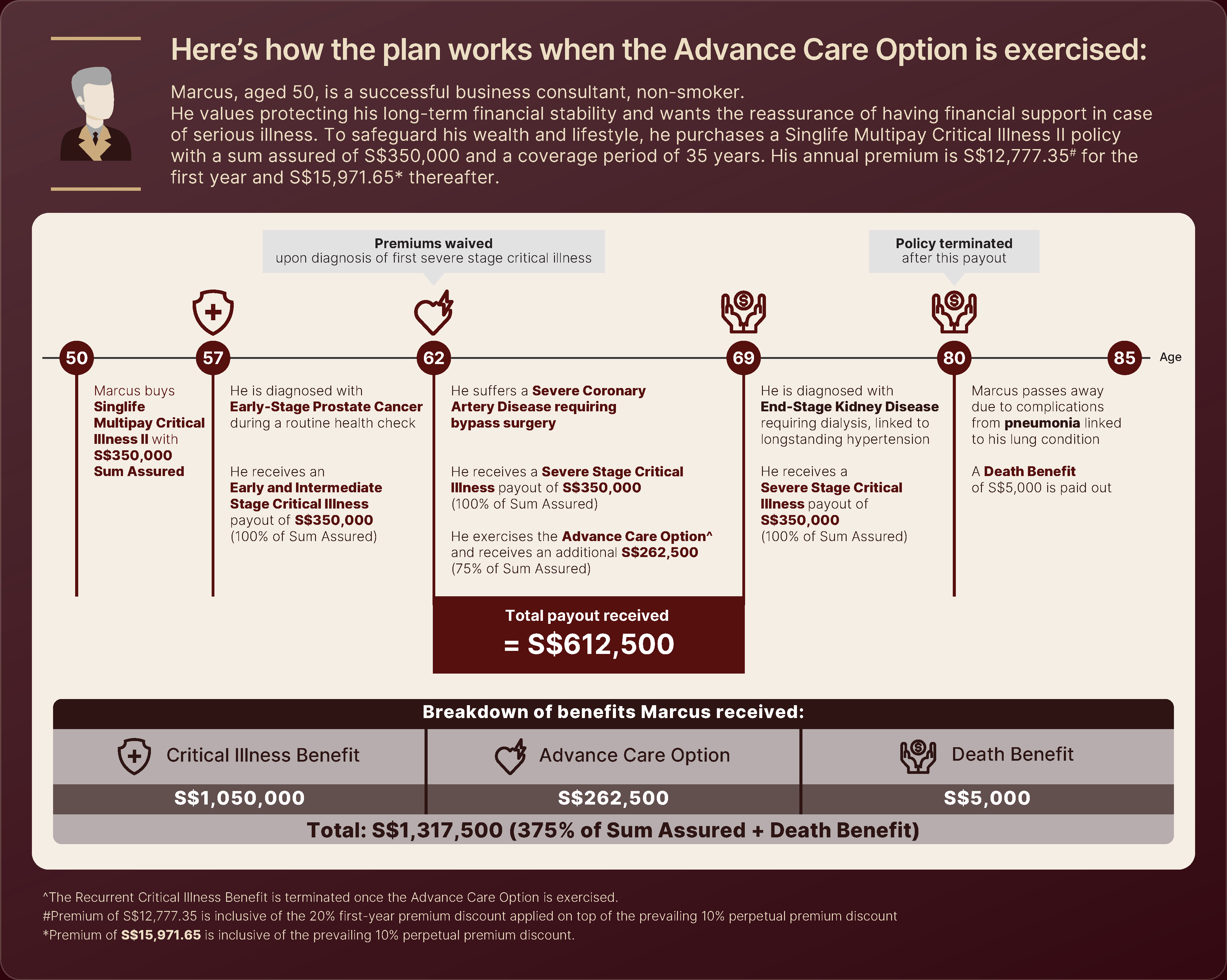

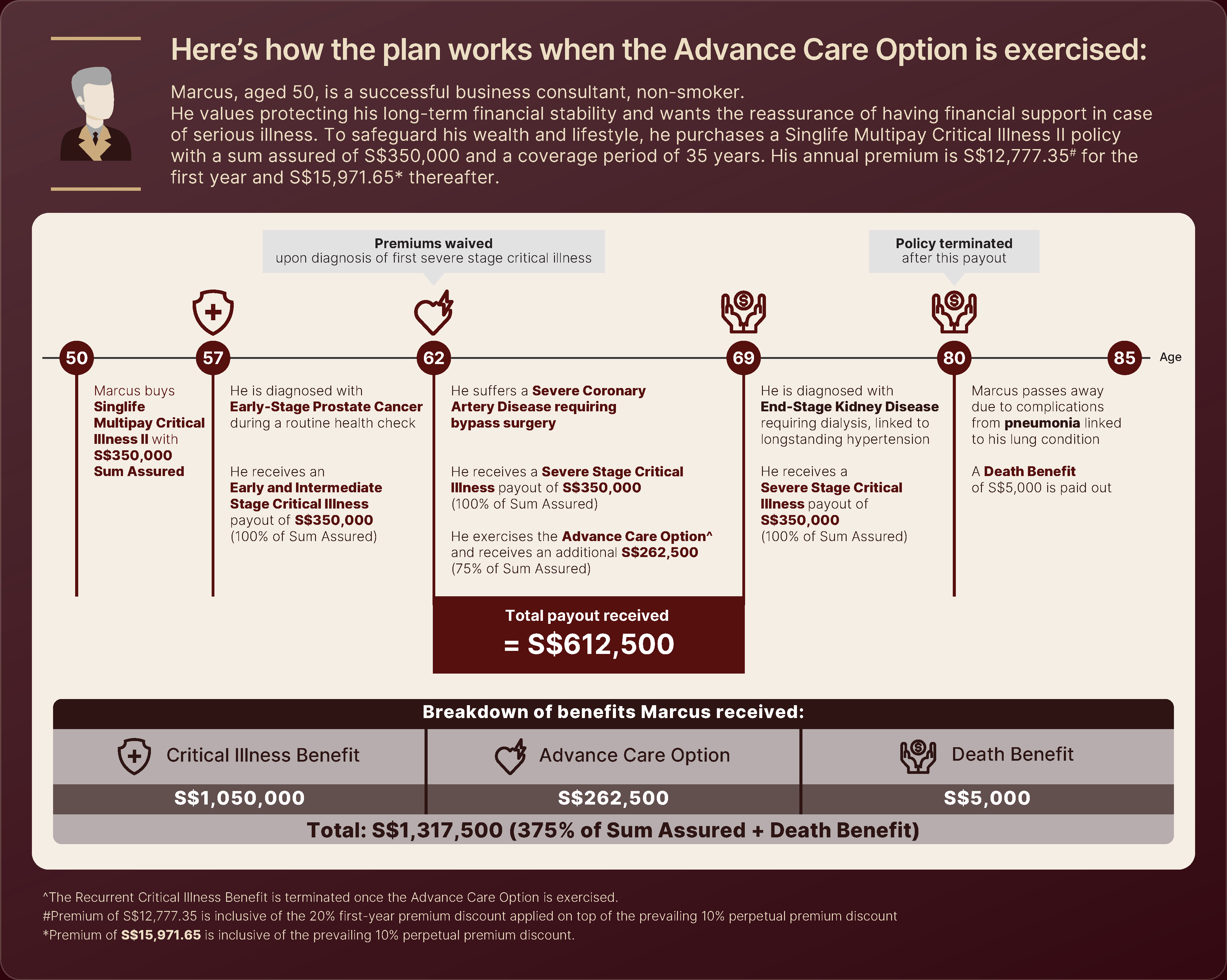

Advance Care Option

From the first severe diagnosis, convert your Recurrent Critical Illness Benefit into an additional payout10

Payout upon death

A S$5,000 lump-sum payout11 supports your family’s financial expenses

Flexible coverage

Choose coverage from 10 years to age 99 (in one-year intervals) and your preferred coverage currency11

Receive 20% of your Sum Assured, up to S$25,000 per life, per condition.

Payout when a borderline malignant tumour or benign tumour (suspected malignancy) requires surgical removal12

Payout when you require a stay in the Intensive Care Unit (ICU) for 4 or more days in one hospital admission13

Payout when diagnosed with any of the 34 covered conditions under the Special Benefit14 (per condition)

How Singlife Multipay Critical Illness II works

Promotions

Exclusive savings

Enjoy 10% perpetual premium discount on Singlife Multipay Critical Illness II and an additional 20% first-year premium discount (applied on top of the perpetual premium discount).

Terms and conditions apply.

Get continuous protection against the unexpected

For a personalised consultation on Singlife Multipay Critical Illness II, simply complete the form, and a dedicated Financial Adviser Representative will be in touch.

Prefer to speak with someone? Our team at Singlife Financial Advisers (“SFA”), a wholly owned subsidiary of Singapore Life Ltd. (“Singlife”) is ready to assist you. Reach us at 6827 9980 (weekdays, 9am to 6pm).

Yay! Form received

Oh no! We encountered an error

Important Notes:

All ages mentioned refer to age next birthday.

1. Source: National Cancer Centre Singapore, retrieved on 11 August 2025 from: https://www.nccs.com.sg/about-nccs/news/publications/in-good-health/issue-10/breast-cancer-today

2. Source: The Straits Times, ‘Princess of Wales’ diagnosis highlights rise in cancer cases among those under 50’ retrieved on 11 August 2025 from https://www.straitstimes.com/singapore/rise-of-cancer-among-those-under-50-highlighted-by-princess-of-wales-diagnosis

3. Source: The Straits Time, ‘More younger adults diagnosed with early-onset colorectal cancer in Singapore’ retrieved on 11 August 2025 from https://www.straitstimes.com/life/more-younger-adults-diagnosed-with-early-onset-colorectal-cancer-in-singapore

4. Source: The Straits Times, “A third of patients with aggressive lymphoma face relapse or death, new drugs offer hope: Study”, retrieved on 28 June 2025 from https://www.straitstimes.com/singapore/health/a-third-of-patients-with-aggressive-lymphoma-face-relapse-or-death-new-drugs-offer-hope-study

5. Source: SingHealth, “Stroke symptoms and treatments”, retrieved on 28 June 2025 from https://www.singhealth.com.sg/symptoms-treatments/stroke#:~:text=

There%20is%20a%205%25%20to%2015%25%20chance%20a,stroke%20%28

Part%202%29%3A%20Where%20can%20you%20seek%20support%3F

6. Source: The Straits Times, “‘Altruistic’ cancer cells die to let others survive so breast cancer recurs, 10-year study shows”, retrieved on 28 June 2025 from https://www.straitstimes.com/singapore/altruistic-cancer-cells-die-to-let-others-survive-so-breast-cancer-recurs-10-year-study-shows

7. Please take note of the following waiting periods:

1) Under Critical Illness (CI) Benefit, there is a one-year waiting period between claims made under the early, intermediate and severe stage CI Benefit. However, there is no waiting period required between an early or intermediate stage CI claim and a first severe stage CI of the same CI group for the activation of premium waiver or Advance Care Option.

2) Under the Recurrent Critical Illness Benefit, there is a two-year waiting period between two Recurrent Critical Illness Benefit claims.

If more than one Critical Illness covered under the Critical Illness Benefit and/or Recurrent Critical Illness Benefit is diagnosed on the same date, We will only admit one claim with the highest possible benefit payout for the Critical Illness diagnosed. For more details on the benefits, waiting periods and the complete list of early, intermediate and severe stage critical illnesses covered in this plan, please refer to the Product Summary.

8. Please refer to the Product Summary for the complete list of early, intermediate and severe stage critical illnesses covered under this plan.

9. Recurrent Critical Illness Benefit pays 150% of the Sum Assured per eligible claim, up to two claims (maximum total 300% of the Sum Assured). It covers six specified severe stage conditions and their recurrences. This benefit applies if the Life Assured is diagnosed with:

(i) any one of the specified Severe Stage Critical Illnesses covered under this benefit, provided the Critical Illness Benefit has ceased; or

(ii) any one of the Recurrent Critical Illnesses covered under this benefit.

The benefit will cease once 300% of the Sum Assured is fully paid out, or when the Advance Care Option is successfully exercised under the Policy, whichever is earlier. Waiting periods and a survival period apply. Please refer to the Product Summary for full details of the benefit terms and conditions.

10. You may exercise the Advance Care Option if the Life Assured is diagnosed with any one of the eligible Severe Stage Critical Illnesses specified under this option for the first time. If this option is successfully exercised, an additional 75% of the Sum Assured will be payable in one lump sum; and the Recurrent Critical Illness Benefit shall cease. Survival period is applicable to this option. Please refer to the Product Summary for more details on the terms and conditions for the Advance Care Option.

View our full suite of products

Our curated solutions are designed to secure your financial future.

Disclaimers

This policy is underwritten by Singapore Life Ltd.

This is published for general information only and does not have regard to the specific investment objectives, financial situation and particular needs of any specific person. You may get a copy of the Product Summary from Singapore Life Ltd. and the participating distributors’ offices. You should read the Product Summary before deciding whether to purchase the product. You may wish to seek advice from a financial adviser representative before making a commitment to purchase the product. If you choose not to seek advice from a financial adviser representative, you should consider whether the product in question is suitable for you. As this product has no savings or investment feature, there is no cash value if the policy ends or if the policy is terminated prematurely. Buying a health insurance policy that is not suitable for you may impact your ability to finance your future healthcare needs. This is not a contract of insurance. Full details of the standard terms and conditions of this policy can be found in the relevant policy contract.

Information is accurate as at 6 Jan 2026.

This advertisement has not been reviewed by the Monetary Authority of Singapore.

This policy is protected under the Policy Owners’ Protection Scheme which is administered by the Singapore Deposit Insurance Corporation (SDIC). Coverage for your policy is automatic and no further action is required from you. For more information on the types of benefits that are covered under the scheme as well as the limits of coverage, where applicable, please contact us or visit the Life Insurance Association or SDIC websites (www.lia.org.sg or www.sdic.org.sg).