Grow your wealth for future needs or legacy planning with our customisable investment-linked plan.

Discover Singlife Legacy Invest, a customisable investment-linked plan (ILP) available in Singapore Dollars (SGD) or United States Dollars (USD), designed to help you achieve your financial goals.

With the flexibility to choose your premium payment duration and policy term, you can grow your wealth in line with your goals. Monthly charges are limited to a fixed period, giving your investment greater potential to grow after, with bonuses to build on your progress.

Whether you’re building a future of opportunities for your children, seeking a passive income stream or enhancing your retirement plan, Singlife Legacy Invest empowers you to steer your path to financial freedom.

Choose to pay at one go with a single premium or regularly over 3, 5 or 10 years and decide on your policy term (10, 15, 20 or 25 years)1 based on your needs.

With monthly charges applying only during the specified charge period, your account value can accumulate without further deductions once the charge period ends, allowing your investment to flourish.

Be rewarded with various bonuses3 such as the Welcome Bonus, Special Booster, Loyalty Bonus and Maturity Bonus to boost your investment.

Other Features and Benefits

Have peace of mind with our Free Partial Withdrawal Benefit4 that allows you to make penalty-free withdrawals upon a key life stage event happening, or if you need funds for any other unexpected situation.

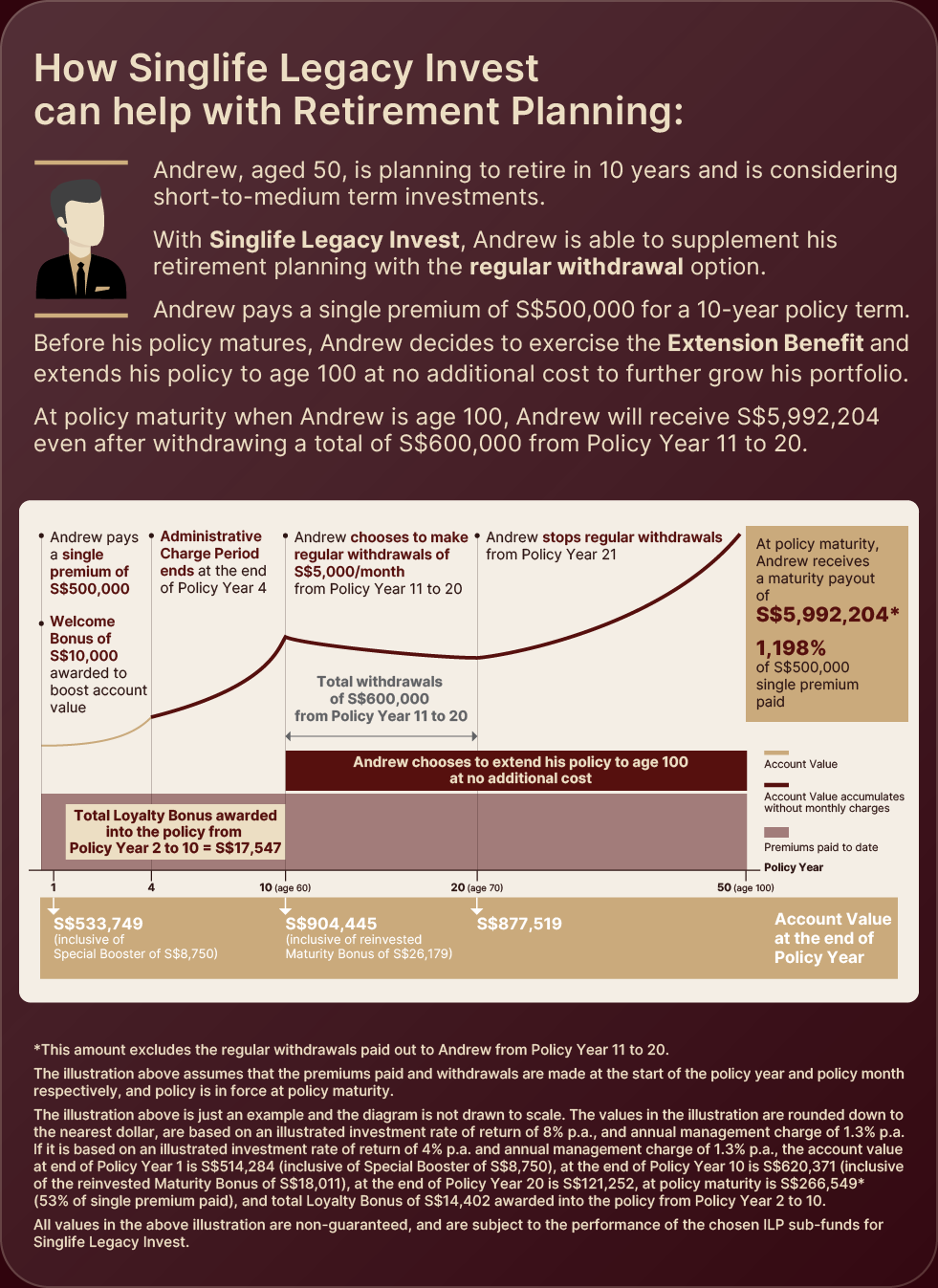

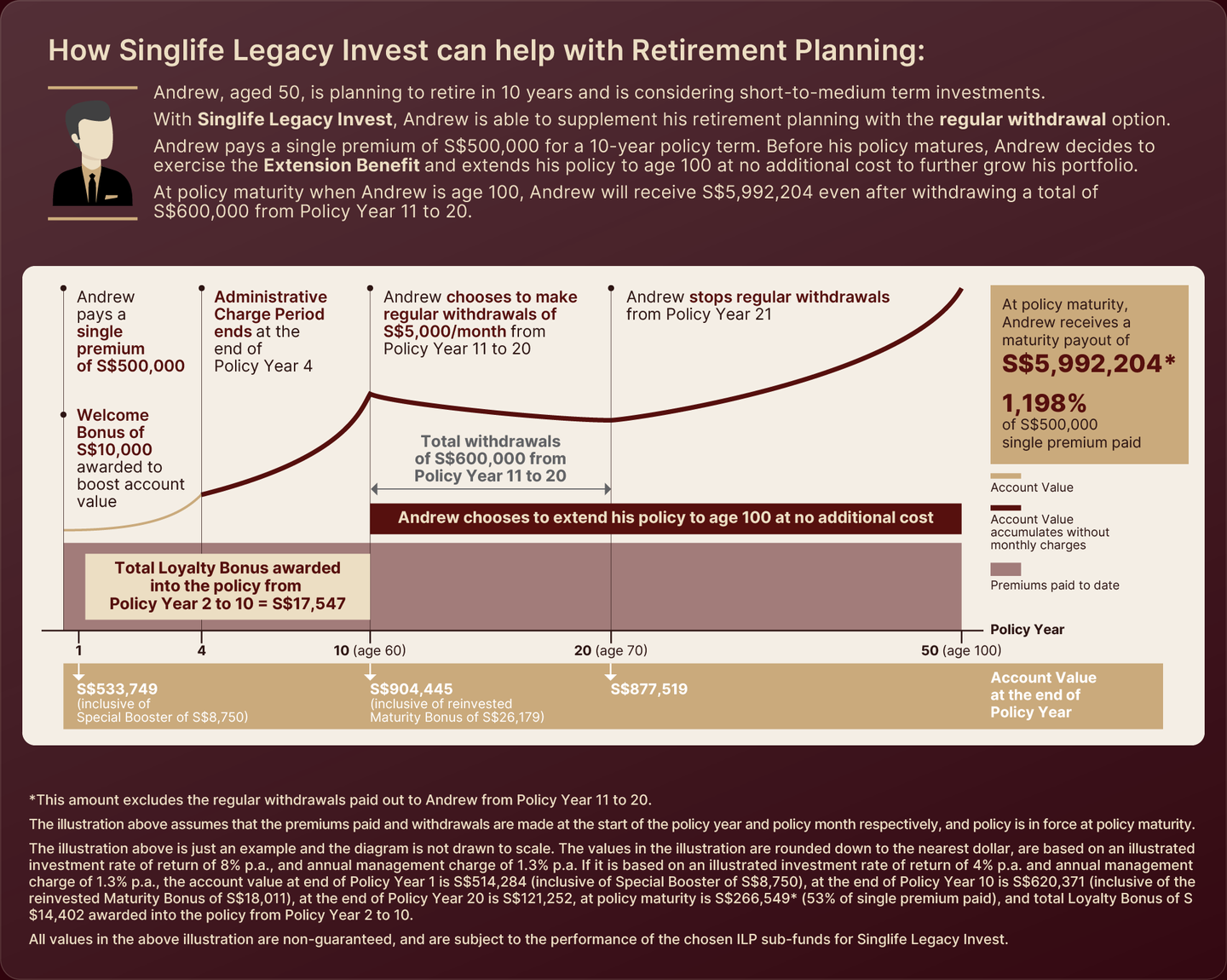

Have the option to make regular withdrawals5 from your policy at your preferred frequency (annually, semi-annually, quarterly or monthly) to support your retirement or any other income needs.

Have the option to extend your coverage term to age 1006 to continue growing your wealth while staying protected at no additional cost.

Benefit from a diverse selection of funds to grow your investment, including dividend-paying ILP sub-funds7 with the option to receive dividends in cash or to reinvest them.

Enjoy coverage against death8 and Terminal Illness9.

Have the option to switch the Life Assured10 to meet you changing needs.

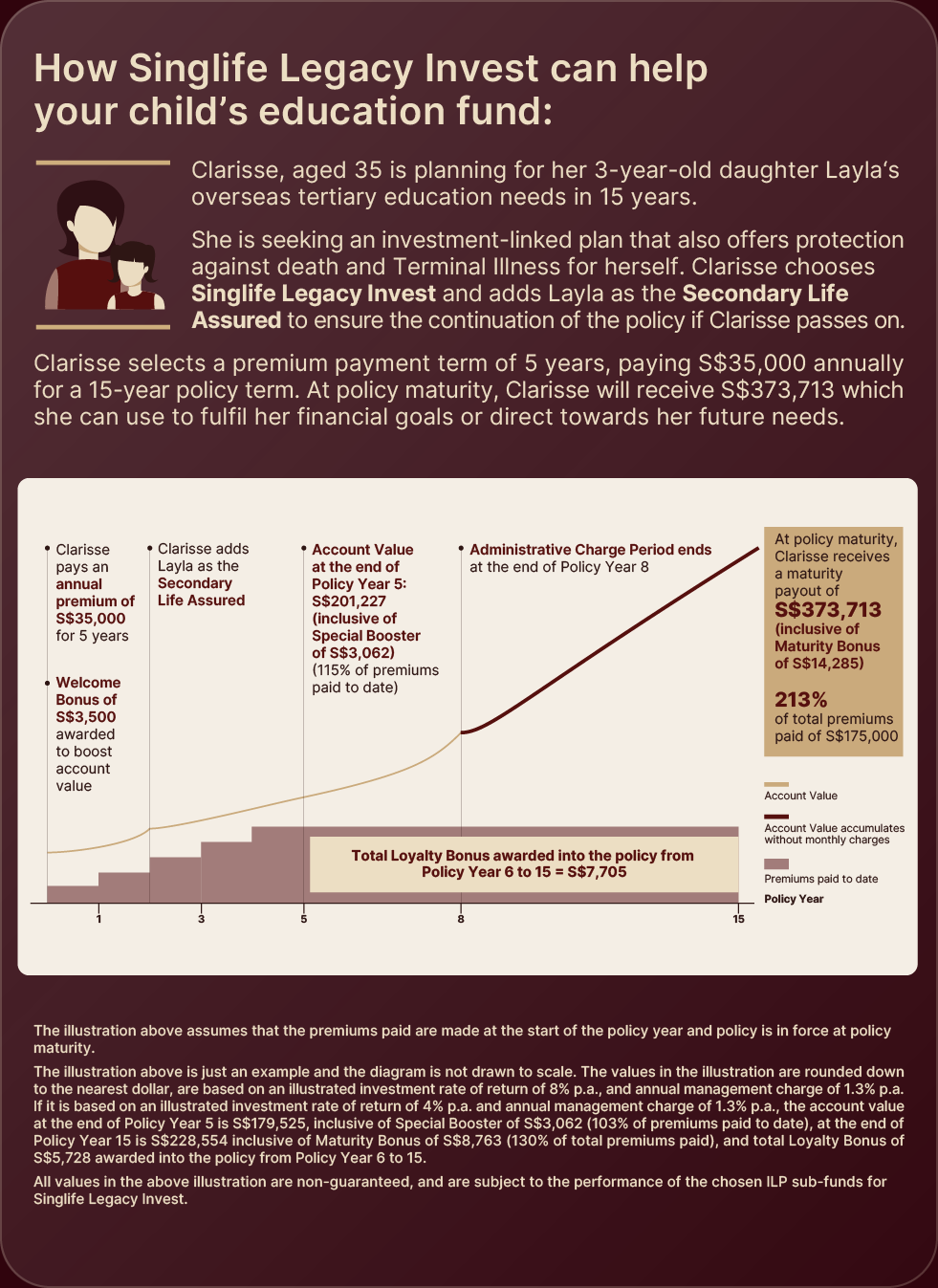

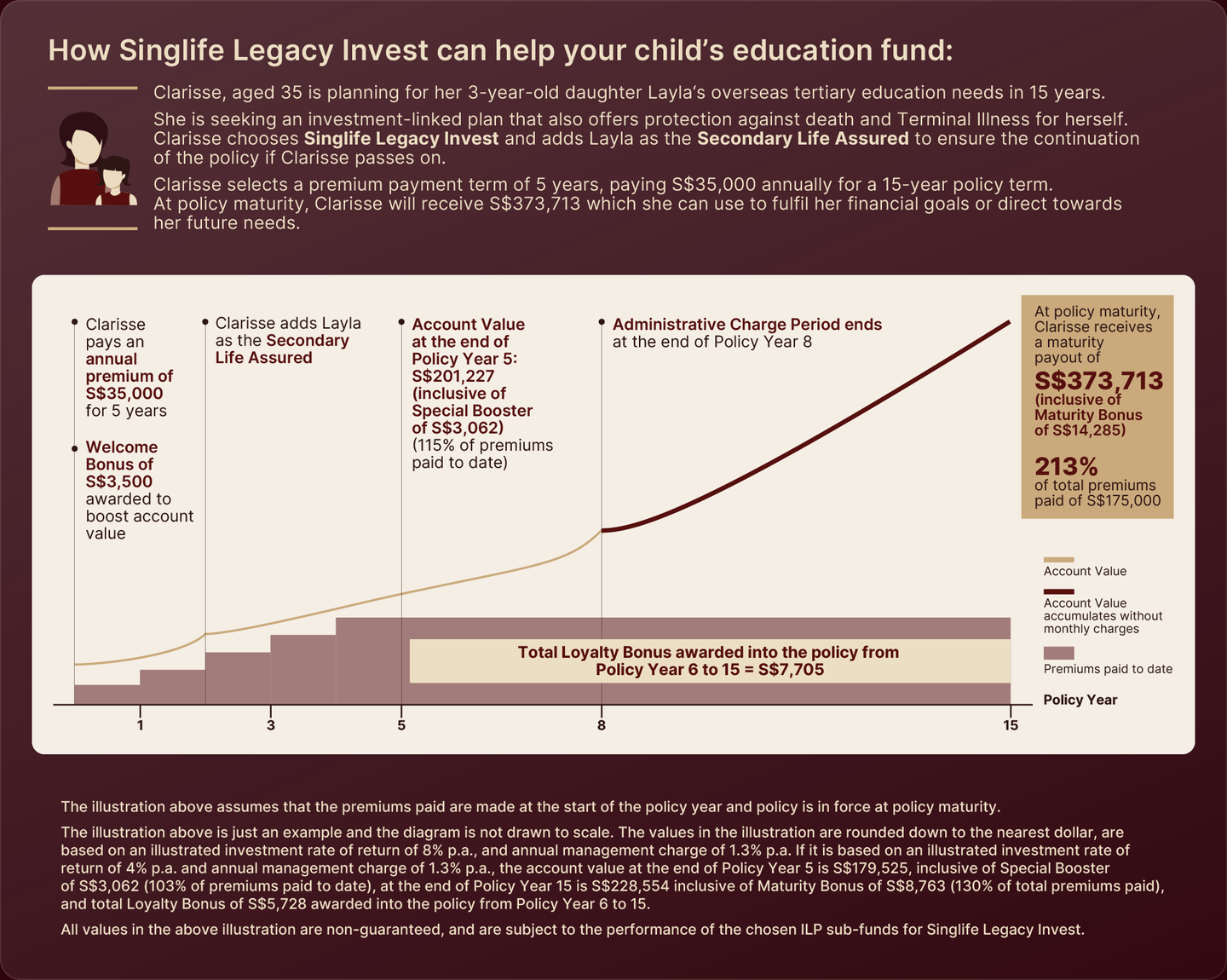

Secure continuity with the option to designate a loved one to be your Secondary Life Assured11 to seamlessly transfer your coverage when you die.

Add on optional riders12 for more comprehensive coverage, against unexpected events, such as total and permanent disability, critical illnesses and more.

Here's How Singlife Legacy Invest Works

Get Additional Welcome Bonus and Premium Cashback when you purchase Singlife Legacy Invest now.

For a personalised consultation on Singlife Legacy Invest, simply complete the form, and a dedicated Financial Adviser Representative will be in touch.

Prefer to speak with someone? Our team at Singlife Financial Advisers (“SFA”), a wholly owned subsidiary of Singapore Life Ltd. (“Singlife”) is here to assist you. Reach us at 6827 9980 (Mon – Fri, 9am to 6pm).

Yay! Form received

Oh no! We encountered an error

All ages mentioned refer to age next birthday.

1 The policy term options vary depending on the premium payment term. Please refer to the Product Summary for more details.

2 This refers to the Administrative Charge which will be deducted monthly from the policy by unit cancellations. This charge is payable during the Administrative Charge Period only. Please refer to the Product Summary for more details.

3 Please refer to the Product Summary for details on each of the bonuses offered under this plan.

4 The Free Partial Withdrawal Benefit consists of Free Partial Withdrawal upon a Life Stage Event and Free Partial Withdrawal without a Life Stage Event. The Policyholder can make up to 2 penalty-free withdrawals for each benefit and each withdrawal is subject to the benefit’s withdrawal limit.

The Life Stage Events covered are:

(a) the Life Assured changes the marital status (i.e. marries, divorces or is widowed);

(b) the Life Assured becomes a parent by having a newborn child, or legally adopts a child;

(c) the Life Assured purchases a property;

(d) the Life Assured or the Life Assured’s child enrols into tertiary education;

(e) the Life Assured reaches retirement age of 65; or

(f) the Life Assured is hospitalised.

Free Partial Withdrawal without a Life Stage Event is only allowed from the 4th policy year onwards. Please refer to the Product Summary for more details on the terms and conditions for Free Partial Withdrawal Benefit.

5 Regular withdrawal is allowed after the Partial Withdrawal Charge Period, subject to terms and conditions. Please refer to the Product Summary for more details.

6 This refers to the Extension Benefit which allows the Policyholder to extend the policy term to age 100 of the original Life Assured before the policy matures. If the Extension Benefit is exercised on the policy, the original policy maturity date will be revised to the policy anniversary date on which the original Life Assured is age 100. Please refer to the Product Summary for more details on Extension Benefit.

7 The dividend distributions of the dividend-paying ILP sub-funds are at the discretion of the relevant fund managers and are not guaranteed.

8 For single premium, the Death Benefit payable is the higher of:

(a) 101% of (single premium paid plus any single premium top-up less any withdrawal made); or

(b) the account value;

less any amount owing to Singapore Life Ltd.

For regular premium of 3, 5 or 10 years, the Death Benefit payable is the higher of:

(a) 101% of (total basic regular premiums paid plus any single premium top-up less any withdrawal made); or

(b) the account value;

less any amount owing to Singapore Life Ltd.

9 The Terminal Illness Benefit is an early payout of the Death Benefit.

10 The Policyholder can request for a change of Life Assured after the first policy year. Any change of Life Assured request is subject to acceptance by Singapore Life Ltd. Please refer to the Product Summary for more details on the terms and conditions for change of Life Assured.

11 The Secondary Life Assured can be the Policyholder himself, his spouse or his child (who is age 18 and below) if the Policyholder is an individual and satisfactory proof must be submitted together with the application. Upon the death of the existing Life Assured, the policy continues with cover on the life of the appointed Secondary Life Assured, and no Death Benefit will be payable. Please refer to the Product Summary for more details on the terms and conditions for appointment of Secondary Life Assured.

12 For more details on the riders, please refer to the respective Product Summaries.

See our full suite of products

Rely on our curated solutions to ensure a secure financial future

Disclaimers

This policy is underwritten by Singapore Life Ltd.

This is published for general information only and does not have regard to the specific investment objectives, financial situation and particular needs of any specific person. You may get a copy of the Product Summary from Singapore Life Ltd and the participating distributors’ offices. You should read the Product Summary before deciding whether to purchase the product. You may wish to seek advice from a financial adviser representative before making a commitment to purchase the product. If you choose not to seek advice from a financial adviser representative, you should consider whether the product in question is suitable for you.

As buying a life insurance policy is a long-term commitment, an early termination of the policy usually involves high costs and the surrender value, if any, that is payable to you may be zero or less than the total premiums paid. This is not a contract of insurance. Full details of the standard terms and conditions of this policy can be found in the relevant policy contract. Investments in this plan are subject to investment risks including the possible loss of the principal amount invested. The value of the units, and the income accruing to the units, may rise or fall. Past performance of the ILP sub-fund(s) is not necessarily indicative of future performance.

Information is accurate as at 6 May 2025. This advertisement has not been reviewed by the Monetary Authority of Singapore.

COMP/2025/05/MKT/257

This policy is protected under the Policy Owners' Protection Scheme which is administered by the Singapore Deposit Insurance Corporation (SDIC). Coverage for your policy is automatic and no further action is required from you. For more information on the types of benefits that are covered under the scheme as well as the limits of coverage, where applicable, please contact us or visit the Life Insurance Association or SDIC websites (www.lia.org.sg or www.sdic.org.sg).