Products

Promotions

Claims

Payments

About us

Blog

Support

INSURE

Invest

Your Life Stage

Plan & Earn

Earn rewards as we tailor a holistic Better Plan just for you.

Individual Claims

ABOUT SINGLIFE

CAREERS

LIFESTUFF

Personal tips, guides and expert advice to master every aspect of your life

Up to 48% OFF Singlife Travel Insurance

Use promo code TRAVEL25 for single trip plans and ANNUAL25 for annual multi-trip plans.

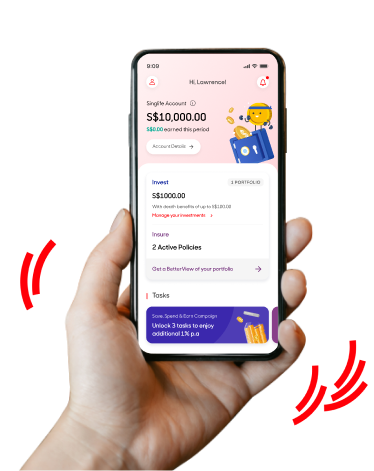

Get the Singlife App

Save, invest, earn, be insured and rewarded all in one app!

Looking for corporate solutions?

CorporatePromo

Up to 48% OFF Singlife Travel Insurance

Use promo code TRAVEL25 for single trip plans and ANNUAL25 for annual multi-trip plans.

Up to 48% OFF Singlife Travel Insurance

Life Insurance

Medical Insurance

Medical Insurance

Critical Illness Insurance

Critical Illness Insurance

Disability Insurance

Disability Insurance

Maternity Insurance

Maternity Insurance

Accident Insurance

Accident Insurance

Savings

Investment-Linked Plans

Investment-Linked Plans

Retirement

Retirement

Singlife Account

Singlife Account

DollarDex

DollarDex

GROW with Singlife

GROW with Singlife

Investment-Linked Plan Funds Reports

Fund Information

Fund Information

View Corporate Insurance products

Investment-Linked Plan Funds Reports

Our Brand Story

Financial Freedom Index

Financial Freedom Index

Leadership Team

Leadership Team

Corporate Governance

Corporate Governance

Newsroom

Newsroom

Sustainability Strategy

Sustainability Strategy

Investor Relations

Investor Relations

Innovation & Ecosystem

Innovation & Ecosystem

Corporate