Whether you’re saving to start a family, trying to support your kids and ageing parents at the same time or catching up on your retirement goals, money can be a source of stress. Things like keeping up with payment due dates and trying to remember which insurer to go to for each of your plans can be trying – especially when you’re juggling many other balls in life.

The good news is, managing money doesn’t have to be hard or add to your load. By streamlining your finances, you’ll feel like a burden has been lifted and more in control of your life.

Ready to uncomplicate your financial life? Here are four moves to simplify your finances …

#1: Focus on the most important goals

Setting financial goals motivates you to achieve your definition of financial freedom. However, when you try to achieve too many of them at the same time, you may not make significant progress on any.

Focus on up to three goals at a time. Of these, one should be building a retirement fund as starting early gives you a longer runway to hit your target.

If you have debts to clear, this could be your second goal. High-interest loans are a common cause of financial worry so the sooner you eliminate your debts, the lighter you’ll feel. Start with the one with the highest interest rate and squash your debts one by one. Use any extra cash you have, such as a year-end bonus, to pay off a big chunk of your debt so you’ll pay less for interest.

Eliminating debt frees up money for other lower-priority goals like home renovation or a family trip.

#2: Automate bill payments

If you’re always struggling to reach the bottom of your financial to-do list, then maybe you should just do less. Yes, you heard us! How? Automate bill payments.

Put your recurring bills, like utility bills, kids’ school fees, car loan repayments, tax payments and EZ-Link card top-ups on GIRO payments or arrange to have them automatically charged to your credit card. Be sure to pay off your credit card bill in full and punctually. To make things even simpler, pay your credit card bills via GIRO as well.

You’ll never have to deal with multiple repetitive payments again and there’s a lower chance of late-payment fines. Just remember to have sufficient funds in your bank account to cover your bills.

Bonus tip: Using just one credit card instantly uncomplicates financial management too – there’s only one balance to look at every month, and you get a clear picture of your spending pattern so you can act fast when things get out of balance. If you put all your expenses on a rewards credit card, you’ll also accumulate points faster.

#3: Dump or digitise paper records

It may be necessary to keep salary slips, bank statements, insurance claims payout letters, donation records, rental income receipts and other finance records for things like tax filing purposes. However, lots of paper lying around creates clutter and it’s a constant reminder of money matters.

How long should you keep your financial documents? Use this as a guide:

- Documents with no tax significance (e.g. utility bills): One year

- Documents with tax significance (e.g. donation receipts): Seven years

- Property-related receipts (e.g. home renovation or improvement, which may be needed to determine property value or when making a home insurance claim): Indefinitely, until you sell your home

Here’s what you can do to eliminate paper clutter and organise your records:

- Opt for e-statements and bills. It helps to save trees, and you won’t be caught in a situation where the paper receipts you’ve dutifully collected are useless by the time you need them because the ink has faded.

- File e-documents. Financial institutions usually keep digital versions your statements and other documents for a year or longer. Download them from your app and save them onto your personal computer in appropriate folders. This is important as over time, older records in your app will become inaccessible to make way for new ones, and some entities charge a fee if you request for old statements.

- Digitise paper records – For hard copy documents, scan and save them on your computer so everything is in one format and in one place. Then, shred and discard them.

#4: Consolidate your insurance

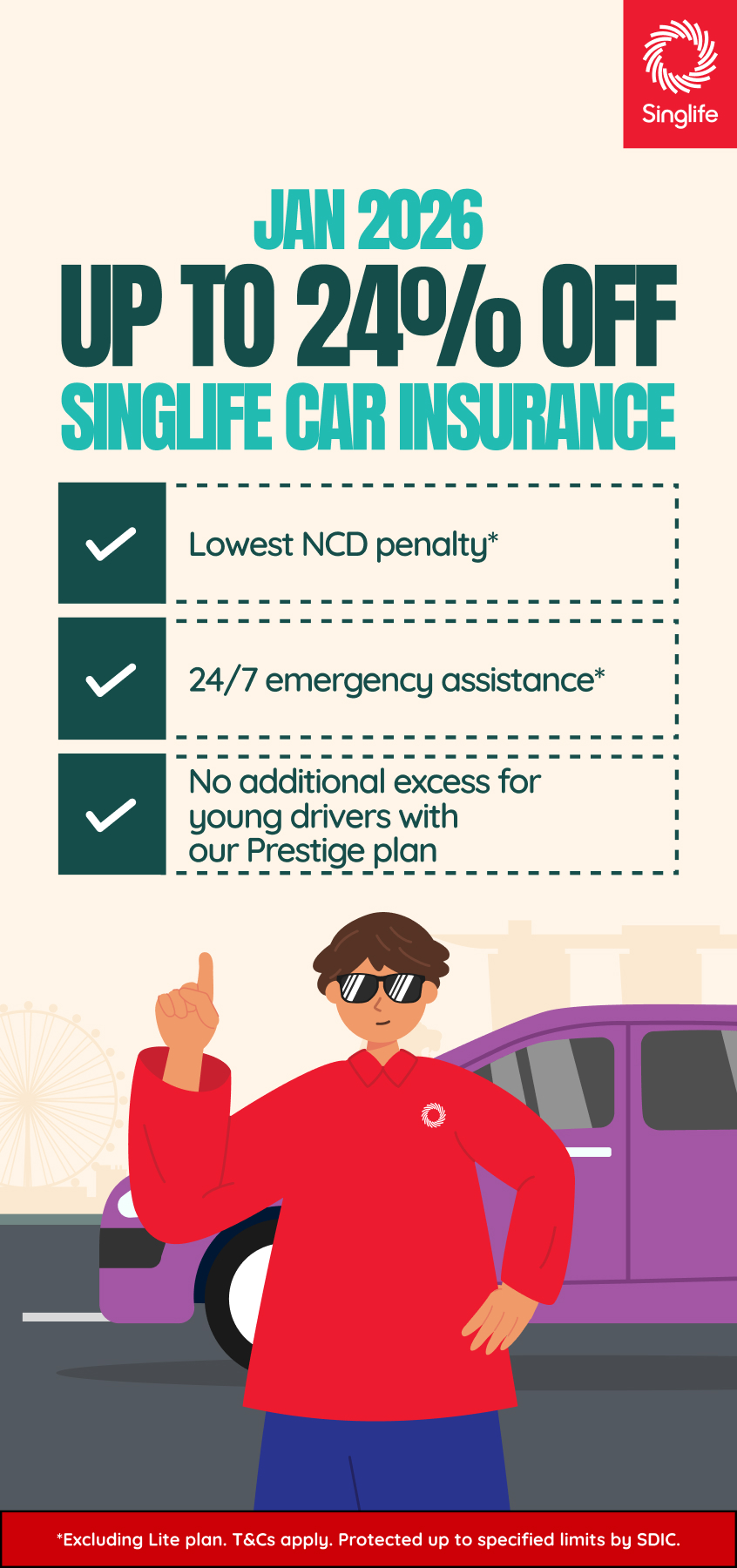

Parking all your insurance – medical, life, home, car etc – under a single insurer gives you the convenience of dealing with one just entity to track claims, renewals, outstanding payments and so on. You can also enjoy perks. For instance, if you’re a group life policyholder, you may be entitled to discounts or upgrades on travel, home, car and personal accident insurance from the same provider.

Another tip to simplify your insurance: Get plans that are easy to understand.

Insurance is a must-have yet complicated plans with tedious application processes, confusing layers and expensive premiums are frustrating. If you agree, look for plans that you can easily understand and enrol for. Singlife Simple Term, for instance, is a term life insurance plan that gives you 100% protection against death, terminal illness and total and permanent disability from just S$0.37^ per day for S$500,000 coverage. You don’t need to undergo medical check-ups, and you can either apply online by answering a few health questions or via a financial adviser representative.

Simplifying and putting your finances in order may take a bit of effort at the start but it’s worth it. You’ll have a better overview of your money, spend less time on repetitive tasks and maybe even save more.

Important Notes

^ Premium of S$0.37 is based on coverage for a non-smoking female, between 1 and 35 age next birthday (both ages inclusive) with annual premium of S$136 divided over 365 days, rounded down to the nearest cent.