You’re in the pink of health with a fountain of wealth. You’re a working professional who wakes up early for work feeling like a spring chicken basking in the spring of its youth.

One day, the family doctor has ominous news to deliver. You’re diagnosed with Type 2 diabetes and can only order siew dai (less sweet) drinks from now on. “Jia lat liao (I’m finished),” you mutter as a chill runs down your spine.

The above is (probably) an exaggerated illustration of how a doctors’ appointment might go – albeit a true reflection of how life can be. The truth: Health surprises can be common among men who neglect to go for annual health checks for years thinking they’re fine. Case in point, a study conducted by the Cleveland Clinic found that 72% of men would rather do household chores than go to the doctor. But don’t get me wrong, keeping the house clean is important.

In the same study, only 50% of men mentioned that they considered getting an annual check-up a regular part of self-care. Well, the fact is that everyone should consider getting annual health checks – the next new disease might just be lurking around the corner.

As a male in my late twenties, I’ve had enough health scares to last two lifetimes and am signing up for my annual health check this year. Having lost a childhood friend in his early twenties to cancer, I witnessed first-hand how non-discriminatory and aggressive diseases can be. I’ve even heard stories of investment bankers in their twenties who fell victim to heart attacks and strokes. Singapore is facing its very own triple threat - cancer, heart attacks and strokes are among the leading causes of death within the population1.

Yep, that’s just how prevalent critical illnesses are. More than 90% of critical illness insurance claims stem from five severe-stage CIs5:

- Major cancer

- Heart attack of specified severity

- Coronary artery by-pass surgery

- Stroke

- End stage kidney failure

Regular health checks are crucial for early detection of these critical illnesses which can cause financial stress, and detecting illness at early stages can also mean less complicated and less costly treatments.

The question is, what do you test for, how often and where?

What tests should men be aware of?

DoctorAnywhere recommends the following tests for the respective age bands:

- High blood pressure: 18 years and older – once every two years

- Diabetes (HbA1c glucose test): 40 years and older – once every three years

- High blood cholesterol: 40 years and older – once every three years

- Prostate cancer (prostate specific antigen test): 40 years and older – once every three years

- Colorectal cancer (faecal occult blood test): 40 years and older – once every year

- Testicular cancer (self-examination for unusual lumps): Monthly

Trust me, you don’t want to be caught with your pants down.

Where should you go for these tests?

- HealthHub’s Screen for Life programme recommends you screen for diabetes if you’re below 40 years of age, and includes high blood pressure and high blood cholesterol if you’re above 40. Available at highly subsidised rates, it gives you bang for your buck (S$5 or less). If you’re looking for more comprehensive tests, however, read on.

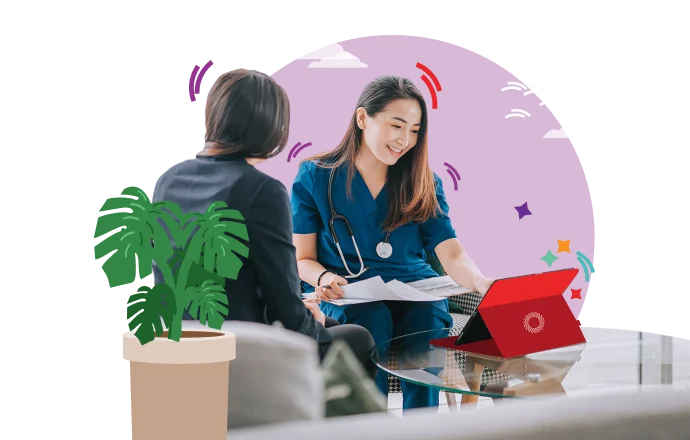

- DoctorAnywhere’s General Health Screening programme offers both home-based and in-clinic health screenings for all ages, with the basic package covering quite a few checks. They’ll measure and monitor your blood count, BMI (Body Mass Index), glucose and cholesterol levels, and kidney and liver functions. For more comprehensive checks, there’s the Prestige package which covers prostate cancer markers, bone and joint health, hepatitis and more.

Health tips and preventive measures

As the adage goes, prevention is better than cure. In addition to going for regular health checks which can help detect illnesses early, it’s important to adopt a healthy lifestyle to minimise your risk for diseases in the first place. So, here are some health tips.

1. Eat nutritious food

For well-balanced meals with the right proportions of each food group, follow the Health Promotion Board’s My Healthy Plate recommendation when filling your plate:

- A quarter plate of whole grains – provides fibre, satiety, vitamins and minerals

- A quarter plate of meat – picking lean over fatty meat and consuming less processed meats like luncheon meat and sausages helps to keep cholesterol in check, reducing the risk of heart disease and stroke

- A half plate of fruits and vegetables – dietary fibre promotes satiety and bowel function while reducing the risk of heart disease and high blood cholesterol

2. Start exercising

- Walking is the simplest way to incorporate exercise into your daily life. Commuting home by train? Instead of taking the escalator to/from the platform, walk briskly or take the stairs to keep your body active.

- Increase intensity levels gradually and take it slow at the start. Certain muscles in the body aren’t used to being under duress and could be more prone to injuries. The American Heart Association has some nuggets of knowledge for long-term exercise success.

3. Stay hydrated

- Drinking enough water to sustain your lifestyle is paramount. If you’re an active individual, you’ll want to ensure you hydrate enough to sustain your lifestyle.

- MayoClinic suggests drinking 3.7 litres of fluids a day for men, and 2.7 litres of fluids a day for women.

- Personal experience: I didn’t hydrate sufficiently during my spin class and pushed myself too hard – won myself a one-week visit to the hospital for Rhabdomyolysis! Not fun and not recommended.

4. Get adequate sleep

- Sleeping well, like all other healthy habits, takes time to inculcate. Maintaining a good seven to eight hours of uninterrupted sleep is a good place to start.

- The Sleep Foundation has some tips to promote sleep, such as relaxing and avoiding overstimulating light before bed, and limiting caffeine intake after 2pm.

5. Curb your drinking habit

- Alcohol is known to be an enemy of quality sleep, disrupting Rapid Eye Movement (REM) sleep cycles in the body. More from the Sleep Foundation here.

- Keeping busy and opting for healthier habits to cope with stress both help to curb excessive drinking. Being more intentional about when and how you drink can also help. More tips from Harvard University here.

A crucial component in men’s health protection

Life is a journey, and so is good health. Annual health check-ups and lifestyle choices have equal parts to play in the orchestra of life. Completing that picture is insurance, because even if you’re young, fit and maintain a healthy lifestyle, there’s a small chance that illnesses can creep up on you.

Singlife Multipay Critical Illness II covers up to 135 conditions across all stages of critical illness. Each diagnosis whether early, intermediate or severe, pays out 100% of your sum assured, with up to 6 claims allowed.

If the illness returns, the plan provides up to 2 additional payouts at 150% for specified recurrent conditions, bringing the total payout to 900% of the sum assured. Premiums are waived upon diagnosis of the first severe stage illness, offering added peace of mind. It’s flexible, lasting protection designed to support long-term needs.

Alternatively, if you prefer a versatile insurance plan, consider a term life insurance plan that gives you the option to add a critical illness rider. For instance, Singlife Elite Term II is an affordable way to ensure your loved ones receive financial support in the event of your death or suffer from terminal illness, and by adding a critical illness rider, you also get the assurance of critical illness payouts, which you can use for things like alternative treatments or income replacement if you need to take an extended break from work to focus on your recovery. You can even add on riders like Critical Illness Premium Waiver (2025) to completely waive off premium payments upon receiving a severe stage critical illness diagnosis. Having adequate insurance coverage allows you to focus on your health, and not worry about medical bills or income loss.

Notes:

1. Source: Ministry of Health, Principal Causes of Death, accessed on 22 June 2023.

2. Source: Singapore Cancer Society, Common Types of Cancer in Singapore, accessed on 23 June 2023.

3. Source: Singapore Heart Foundation, Heart Conditions, Heart Attack, accessed on 23 June 2023.

4. Source: Health Promotion Board, National Registry of Diseases Office, “Singapore Stroke Registry Annual Report 2020”.

5. Life Insurance Association, Life insurance industry refines Critical Illness definitions for clarity on intended scope of coverage in light of medical advances in recent years., accessed on 10 June 2024

6. Please refer to the Product Summary for the complete list of early, intermediate and severe stage critical illnesses covered under this plan.

As these products have no savings or investment feature, there are no cash value if these policy ends or if the policies are terminated prematurely. Buying a health insurance policy that is not suitable for you may impact your ability to finance your future healthcare needs.

This advertisement has not been reviewed by the Monetary Authority of Singapore.